goldman sachs p2p

And Prosper has outstanding customer reviews. Ad Ensure Your Investments Align with Your Goals.

Long Take Why Peer To Peer Models Fail Against Oligopoly With Lending Club Shutting Down P2p Platform Seedrs Crowdcube Merging And Morgan Stanley Buying Eaton Vance For 7b

We may share your information with other subsidiaries of The Goldman Sachs Group Inc.

. Goldman has been keeping its plans under wraps but some details have been leaked. According to the interview the new. Goldman Sachs made its latest investment into a peer-to-peer lending platform last month continuing a long track record of support for the sector.

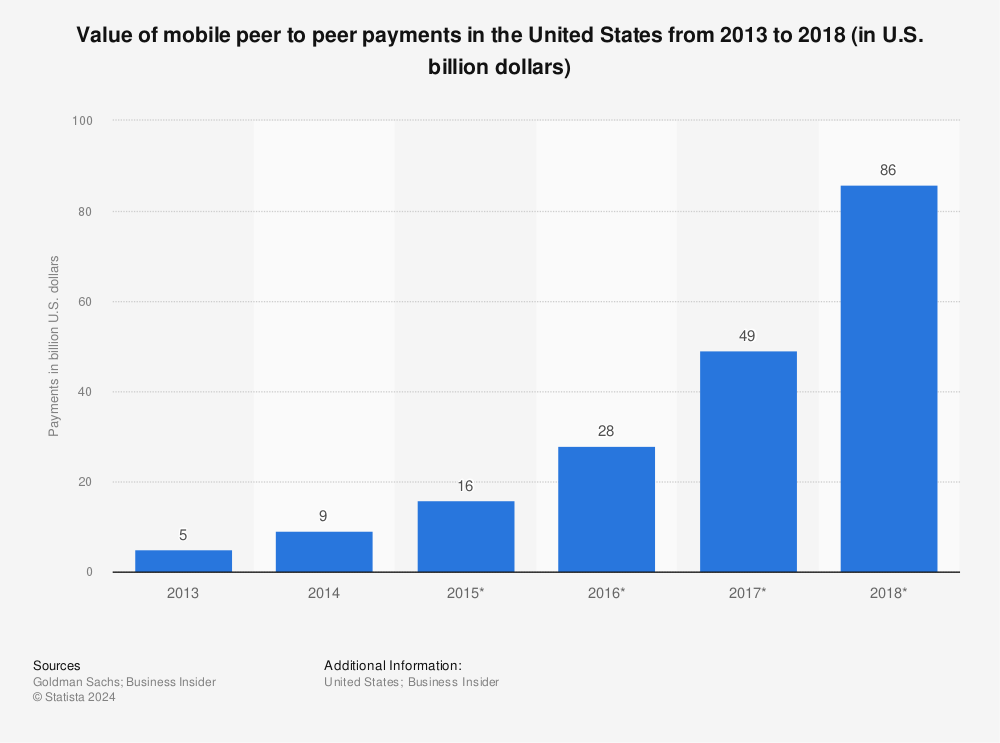

Goldmans entry into the online lending market is a telling sign of how technology is transforming the banking industry. 28 billion paid through Chase QuickPay. However like the case of Goldman Sachs existing P2P and marketplace operators are not alone in their goals to disrupt the business models of banks and other large.

In this five part video he elaborates upon the. The online lending market also known as peer-to-peer. Our Financial Advisors Offer a Wealth of Knowledge.

Exclusive interview with Initiative Irelands Padraig W. Via Thomas Greco. Investment banks in early discussions with online invoice financing company Aztec Money.

Reporter Matt Taibbi recently wrote an article for Rolling Stone called The Great American Bubble Machine. Chase QuickPay transactions grew 38 in 2016. To withdraw your consent to receive calls or to change your.

Proving that age is nothing but a number. Goldman Sachs is entering P2P lending. Close infographic modal button.

A client survey by Goldman Sachs found 40 per cent of institutional investors currently have exposure to cryptocurrencies and 61 per cent expect their digital asset holdings. Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a. Marcus by Goldman Sachs provides no-fee personal loans high-yield online savings for individuals.

Initiative Ireland promotes its chief. Goldman Sachs. A P2P payment is a payment you make directly to another person using a P2P payment service.

The banking giants asset. This is a major milestone for our industry since it marks the 1st bank to enter. The new lending unit which has been dubbed Mosaic will lend its own money via its.

Ayco Personal Financial Management. Searching for Financial Security. The New York Times posted a lengthy article about Goldmans plans to launch its online lending platform and compete with top platforms like Lending Club and ProsperThere are many details yet to be known but according to the New.

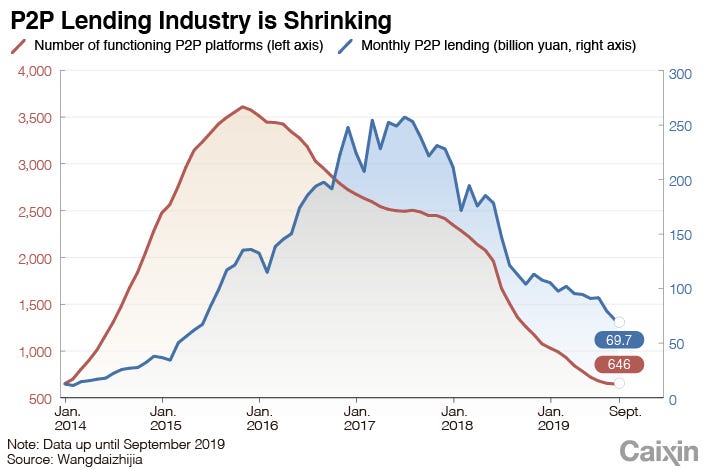

Goldman Sachs plans to stage its second-ever conference for small-business owners next month after a pandemic-induced hiatus with guests including Warren Buffett. Initial public offerings of Chinese P2P lenders in recent months people with knowledge of the matter said. Goldman remains the only large bank to announce plans to start its own platform.

Equity Execution Services Client Communications. And they may also contact you directly. This news hails from an interview between Goldmans head of strategy Stephen Scherr that was published in the Financial Times FT earlier this month.

With P2P payments users can quickly send funds while keeping their. Goldman Sachs Group Inc. Walked away from US.

Goldman Sachs P2P Finance News P2P lending Comments Goldmans GS Bank Move Asks Questions Of Crowdfunders Martin Baker April 26. Find a Dedicated Financial Advisor Now. This entry was posted in Featured Headlines General News Opinion and tagged goldman sachs lending club marketplace p2p peer to peer prosper sofi.

Goldman Sachs made its latest investment in a peer-to-peer lending platform last month continuing a long history of supporting the industry. LLC GSCo which are subsidiaries of The Goldman Sachs Group Inc. Goldman Sachs produced a report in 2018 that provided an overview of the B2B payments market at the time.

Goldman has been keeping its plans under wraps but some details have been leaked. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and Goldman Sachs Co. Committed to helping customers reach their financial goals.

Their premise was that B2B as opposed to B2C C2C or B2G.

.jpg)

P2p Lending Collaboration Will Be The Key To Success The Asian Banker

.jpg)

P2p Lending Collaboration Will Be The Key To Success The Asian Banker

Peer To Peer Lending Crosses 1 Billion In Loans Issued Techcrunch

How To Use Facebook Messenger P2p Payments Loanry

From The People For The People The Economist

Lendingclub Shuts Retail P2p Offering As It Focuses On Institutional Investors Fintech Futures

Goldman Sachs The 150 Year Old Investment Bank Is Staking Its Future On A Mobile App National Crowdfunding Fintech Association Of Canada

Long Take Why Peer To Peer Models Fail Against Oligopoly With Lending Club Shutting Down P2p Platform Seedrs Crowdcube Merging And Morgan Stanley Buying Eaton Vance For 7b

.png)

With P2p Stagnant Where Is Zelle Getting Its Growth Paymentssource American Banker

Report Banks Push Back On Unauthorized P2p Claims Pymnts Com

.jpg)

P2p Lending Collaboration Will Be The Key To Success The Asian Banker

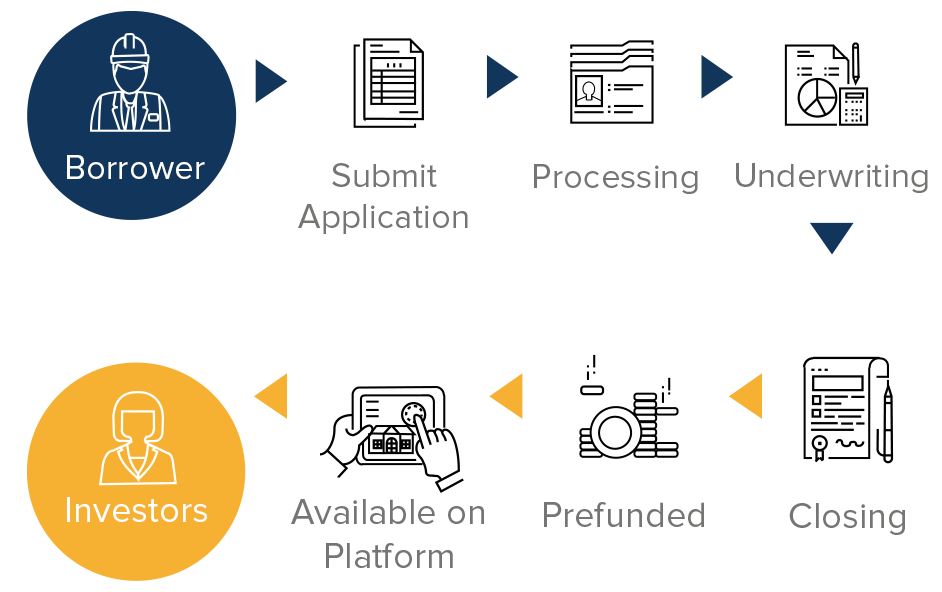

What Is Marketplace Lending Sharestates

Depay Brings Their Web3 P2p Payment Gateway To Eligible Shopify Merchants Crypto News Flash

The 10 Largest P2p And Marketplace Lending Deals Of Q2 2017 Altfi

Goldman Sachs Blockchain Billions Ripple

Goldman Sachs Backed Kaspi Revives London Ipo Plans Fintech Futures

More Boomers Give P2p Payments By Smartphone A Try

P2p Lending Volumes Social Credit Online Financing Fintech Conferences

Comments

Post a Comment